1. A private not-for-profit health care organization has the following account balances: Revenue from newsstand . ....

Question:

1. A private not-for-profit health care organization has the following account balances:

Revenue from newsstand . . . . . . . . . . . . . . . . . . . . . . . . . $ 50,000

Amounts charged to patients . . . . . . . . . . . . . . . . . . . . . . 800,000

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000

Salary expense—nurses . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000

Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Undesignated gifts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000

Contractual adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . 110,000

What is reported as the hospital’s net patient service revenue?

a. $880,000.

b. $800,000.

c. $690,000.

d. $680,000.

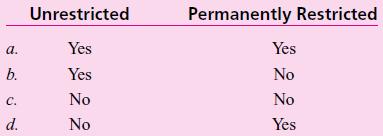

2. A large not-for-profit organization’s statement of activities should report the net change for net assets that are

3. Which of the following statements is true?

I. Private not-for-profit universities must report depreciation expense.

II. Public universities must report depreciation expense.

a. Neither I nor II is true.

b. Both I and II are true.

c. Only I is true.

d. Only II is true.

4. A private not-for-profit organization receives three donations:

One gift of $70,000 is unrestricted.

One gift of $90,000 is restricted to pay the salary of the organization’s workers.

One gift of $120,000 is restricted forever with the income to be used to provide food for needy families.

Which of the following statements is not true?

a. Temporarily restricted net assets have increased by $90,000.

b. Permanently restricted net assets have increased by $210,000.

c. When the donated money is spent for salaries, unrestricted net assets increase and decrease by the same amount.

d. When the donated money is spent for salaries, temporarily restricted net assets decrease.

5. A donor gives Charity 1 $50,000 in cash that it must convey to Charity 2. However, the donor can revoke the gift at any time prior to its conveyance to Charity 2. Which of the following statements is true?

a. Charity 1 should report a contribution revenue.

b. The donor continues to report an asset even after it is given to Charity 1.

c. As soon as the gift is made to Charity 1, Charity 2 should recognize a contribution revenue.

d. As soon as the gift is made to Charity 1, Charity 2 should recognize an asset.

6. A private not-for-profit university charges its students tuition of $1 million. However, financial aid grants total $220,000. In addition, the school receives a $100,000 grant restricted for faculty salaries. Of this amount, it spent $30,000 appropriately this year. On the statement of activities, the school reports three categories: (1) revenues and support, (2) net assets reclassified, and (3) expenses. Which of the following is not true?

a. Unrestricted net assets should show an increase of $30,000 for net assets reclassified.

b. In the unrestricted net assets, the revenues and support should total $1 million.

c. Unrestricted net assets should recognize expenses of $30,000.

d. Unrestricted net assets shows the $220,000 as a direct reduction to the tuition revenue balance.

7. A private not-for-profit organization has the following activities performed by volunteers who work at no charge. In which case should it report no amount of contribution?

a. A carpenter builds a porch on the back of one building so that patients can sit outside.

b. An accountant does the organization’s financial reporting.

c. A local librarian comes each day to read to the patients.

d. A computer expert repairs the organization’s computer.

8. To send a mailing, a private not-for-profit charity spends $100,000. The mailing solicits donations and provides educational and other information about the charity. Which of the following is true?

a. No part of the $100,000 can be reported as a program service expense.

b. Some part of the $100,000 must be reported as a program service expense.

c. No authoritative guidance exists, so the organization can allocate the cost as it believes best.

d. Under certain specified circumstances, the organization should allocate a portion of the $100,000 to program service expenses.

9. The financial reporting for private not-for-profit organizations focuses on

a. Basic information for the organization as a whole.

b. Standardization of fund information reported.

c. Inherent differences of not-for-profit organizations that impact reporting presentations.

d. Distinctions between current fund and noncurrent fund presentations.

10. On December 30, 2010, Leigh Museum, a not-for-profit organization, received a $7,000,000 donation of Day Co. shares with donor-stipulated requirements as follows:

The museum is to sell shares valued at $5,000,000 and use the proceeds to erect a public viewing building.

The museum is to retain shares valued at $2,000,000 and use the dividends to support current operations.

As a consequence of its receipt of the Day shares, how much should Leigh report as temporarily restricted net assets on its 2010 statement of financial position?

a. $–0–.

b. $2,000,000.

c. $5,000,000.

d. $7,000,000.

Step by Step Answer:

Advanced Accounting

ISBN: 978-0077431808

10th edition

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik