1. Explain Merrill Lynchs fair value and fair value option notes (Exhibits 4 and 11). 2. Why...

Question:

1. Explain Merrill Lynch’s fair value and fair value option notes (Exhibits 4 and 11).

2. Why did Merrill Lynch elect the fair value option for only some of its available-for-sale securities ($ 8.723 billion carrying value prior to adoption, Exhibit 4, first Fair Value Option table, column 1)?

3. Explain the 2008 $ 7.617 billion of “Net unrealized losses on investment securities available- for- sale” in Exhibit 9, Statements of Comprehensive (Loss)/ Income.

4. The third from the last table in Exhibit 11 shows that in 2008, Merrill Lynch included a $ 15.938 billion gain in “ Principal Transactions” (column 1) and $ 1.709 billion in “ Other Revenues” (column 2) because the fair value of its long-term borrowings decreased. That table also shows that in 2007 Merrill included additional gains of $ 3.857 billion in “Principal Transactions” (column 4) and $ 1.182 billion in “Other Revenues,” (column 5) because the fair value of its long-term borrowings decreased (a total of $ 22.686 billion for the two years). Explain these gains. Were they real?

5. The last page of Exhibit 11 shows that at year- end 2008, Merrill had $ 62.244 billion at face value ($ 49.521 billion at fair value) of its own debt for which it elected the fair value option. On that same page Merrill states:

The changes in the fair value of liabilities for which the fair value option was elected that was attributable to changes in Merrill Lynch credit spreads were estimated gains of $ 5.1 billion for the year ended December 31, 2008.

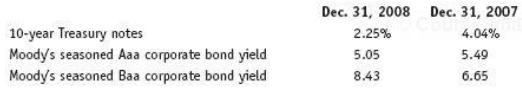

The following are yields on various fixed-income securities:

Is Merrill’s statement that its gain from the increase in its credit spreads was $ 5.1 billion reasonable? Explain.

6. What was Merrill’s total pre- tax loss for the 18- month period June 30, 2007, to December 31, 2008? Did you adjust for the effects of AFS securities and the fair value election for Merrill Lynch’s own debt? Why, or why not.

7. Suppose you were restructuring Merrill Lynch. Which segments of Merrill Lynch are profitable? As part of your analysis, estimate Merrill Lynch’s total losses from its “Principal Transactions” from June 30, 2007, through December 31, 2008. Include an explanation of the $ 7.617 billion of unrecognized losses from “Net unrealized losses on available- for- sale securities” in Exhibit 8. Also include an explanation of the $ 17.647 billion realized gains in “Principal Transactions” and “Other Revenues” for 2008 and $ 5.039 billion for 2007 in the first Fair Value Option table of Exhibit 11. Revenues for Principles transactions are reported as a separate line item on Merrill’s income statements (Exhibits 1 and 5). Most revenues for principles transactions are included in FICC in Notes 3 and 10, Business Segments. Expenses are also shown in Notes 3 and 10, although not by business segment.

8. Suppose the fair value of the assets and liabilities on Merrill Lynch’s December 31, 2008, balance sheet (Exhibit 6) are valid. What was Merrill Lynch’s value on that date?

9. Evaluate the quality of Merrill’s Business Segment disclosures.

10. Did the new fair value rules in ASC 820 (FAS 157) and the new fair value option rules in ASC 825-10 (FAS 159) cause or contribute to Merrill’s problems? Explain in detail.

11. What were Bank of America’s primary risks when it acquired Merrill Lynch? Explain.

On January 6, 1914, Charles Merrill opened Charles E. Merrill & Co. Five months later, he convinced Edmund C. Lynch to join him, and they opened an office at 7 Wall Street. The following year they renamed the firm Merrill, Lynch & Co. At the time, an associate noted, “Merrill could imagine the possibilities; Lynch imagined what might go wrong in a malevolent world.”

Almost from the start, the firm operated a retail brokerage firm and an investment bank. Over the years, it dabbled in various industries, including a film company in 1921 later sold to Joseph P. Kennedy and Cecil B. DeMille and renamed RKO Pictures, as well a stake in the retail market through a controlling interest in Safeway Stores, the grocery chain. By 1928, Mr. Merrill was concerned about the speculative stock market boom, and he advised brokerage clients to “take advantage of present high prices and put your financial house in order.”

In 1930, as the depression worsened, Merrill, Lynch & Co. decided to devote itself to investment banking and sold its retail brokerage business to E. A. Pierce. Mr. Merrill focused on Safeway Stores and built it into the nation’s third- largest grocery store chain. In 1932, Mr. Merrill founded Family Circle, the first grocery store point- of- sale magazine. Mr. Lynch died in 1938 at the age of 52. Mr. Merrill, out of respect to his partner, dropped the comma in the firm’s name.

Merrill Lynch reacquired its brokerage business in 1940 by merging with E. A. Pierce & Cassatt. The following year the firm merged with Fenner & Beane, and the new firm, Merrill Lynch, Pierce, Fenner & Beane, became the world’s largest securities house, with offices in 93 cities. In 1964, it acquired C. J. Devine and became a fixed income securities dealer. In 1976, the firm created Merrill Lynch Asset Management and in 1978 acquired White, Weld & Co., an old- line international investment banking house. By 1988, Merrill Lynch topped the list of firms that handle U. S. and global debt and equity underwriting for the first time; in 1997, Merrill Lynch became the first financial services firm to manage more than $ 1 trillion in client assets.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer: