1. Prepare a monthly cash budget for the three-month period ending in December. 2. If the firms...

Question:

1. Prepare a monthly cash budget for the three-month period ending in December.

2. If the firm’s beginning cash balance for the budget period is $7,000, and this is its desired minimum balance, determine when and how much the firm will need to borrow during the budget period. The firm has a $50,000 line of credit with its bank, with interest (10 percent annual rate) paid monthly. For example, interest on a loan taken out at the end of September would be paid at the end of October and every month thereafter as long as the loan was outstanding.

Philip Spencer of the Spencer Corporation wants you to forecast the firm’s financing needs over the fourth quarter (October through December). He has made the following observations relative to planned cash receipts and disbursements:

• Interest on a $75,000 bank note (principal due next March) at an 8 percent annual rate is payable in December for the threemonth period just ended.

• The firm follows a policy of paying no cash dividends.

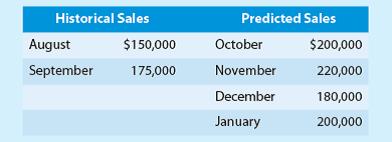

• Actual historical and future predicted sales are as follows:

• The firm has a monthly rental expense of $5,000.

• Wages and salaries for the coming months are estimated at $25,000 per month.

• Of the firm’s sales, 25 percent is collected in the month of the sale, 35 percent one month after the sale, and the remaining 40 percent two months after the sale.

• Merchandise is purchased one month before the sales month and is paid for in the month it is sold. Purchases equal 75 percent of sales.

• Tax prepayments are made quarterly, with a prepayment of $10,000 in October based on earnings for the quarter ended September 30.

• Utility costs for the firm average 3 percent of sales and are paid in the month they are incurred.

• Depreciation expense is $20,000 annually.

Cash BudgetA cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Small Business Management Launching & Growing Entrepreneurial Ventures

ISBN: 978-1133947752

17th edition

Authors: Justin Longenecker, William Petty, Leslie Palich, Frank Hoy