1. Which of the following statements about consistent financial analysis is correct? a. Accounting standards are different...

Question:

1. Which of the following statements about consistent financial analysis is correct?

a. Accounting standards are different across countries.

b. If the input data are the same, the ratios for companies across countries are the same.

c. We can directly compare ratios from annual reports of companies across countries.

d. Debt ratio is calculated in the same way by companies across countries.

2. Which of the following ratios is not in the DuPont system?

a. Net profit margin

b. Leverage

c. Asset turnover

d. Current ratio

3. Which of the following components of the DuPont system for Hill Inc. is correct if sales are $5,600; earnings before tax (EBT) are $2,090; the tax rate is 40 percent; total liabilities are $30,900; and equity is $16,500?

a. Net profit margin = 37.32 percent

b. Asset turnover = 11.81 percent

c. Leverage = 1.87

d. Leverage = 0.53

4. To increase return on equity (ROE),

a. Increase equity, all else being unchanged.

b. Decrease debt outstanding, all else being unchanged.

c. Decrease corporate tax rate, all else being unchanged.

d. Decrease earnings after tax, all else being unchanged.

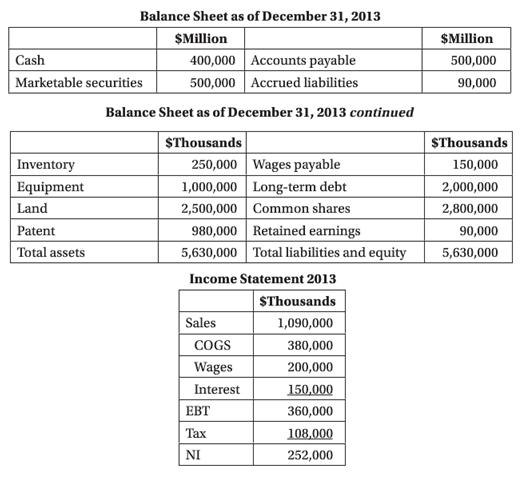

Use the following information to answer practice problems 5 to 8.

Question continue to next page

5. What is the company’s debt ratio?

a. 0.36

b. 0.94

c. 0.55

d. 0.49

6. Calculate the debt-equity ratio and times interest earned ratio.

a. 3.56; 0.32

b. 0.95; 2.4

c. 0.69; 3.4

d. 2.4; 0.95

7. What are the company’s gross profit and its operating margin? (Use EBIT as operating income.)

a. 75 percent; 25 percent

b. 65 percent; 47 percent

c. 55 percent; 30 percent

d. 70 percent; 49 percent

8. Which of the following are average day’s revenues in inventory?

a. 84 days

b. 70 days

c. 66 days

d. 82 days

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Introduction To Corporate Finance

ISBN: 9781118300763

3rd Edition

Authors: Laurence Booth, Sean Cleary