A bank has the following balance sheet: Suppose interest rates rise such that the average yield on

Question:

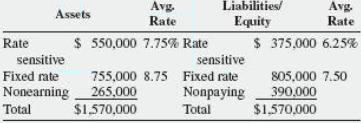

A bank has the following balance sheet:

Suppose interest rates rise such that the average yield on rate- sensitive assets increases by 45 basis points and the average yield on rate- sensitive liabilities increases by 35 basis points.

a. Calculate the bank’s repricing GAP and percentage gap.

b. Assuming the bank does not change the composition of its balance sheet calculate the resulting change in the bank’s interest income, interest expense, and net interest income?

c. Explain how the CGAP and spread effects influenced the change in net interest income.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets and Institutions

ISBN: 978-0077861667

6th edition

Authors: Anthony Saunders, Marcia Cornett

Question Posted: