A division of Hewlett-Packard assembles and tests printed circuit (PC) boards. The division has many different products.

Question:

A division of Hewlett-Packard assembles and tests printed circuit (PC) boards. The division has many different products. Some are high volume; others are low volume. For years, manufacturing overhead was applied to products using a single overhead rate based on direct-labor dollars. However, direct labor has shrunk to 6% of total manufacturing costs.

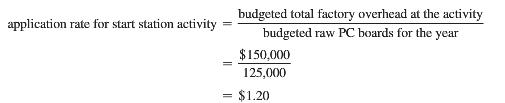

Managers decided to refine the division’s product-costing system. Abolishing the direct-labor category, they included all manufacturing labor as a part of factory overhead. They also identified several activities and the appropriate cost-allocation base for each. The cost-allocation base for the first activity, the start station, was the number of raw PC boards. The application rate was computed as follows:

Each time a raw PC board passes through the start station activity, $1.20 is added to the cost of the board. The product cost is the sum of costs directly traced to the board plus the indirect costs (factory overhead) accumulated at each of the manufacturing activities undergone.

Using assumed numbers, consider the following data regarding PC board 37:

Direct materials ……………… $55.00

Factory overhead applied …………. ?

Total manufacturing product cost …. ?

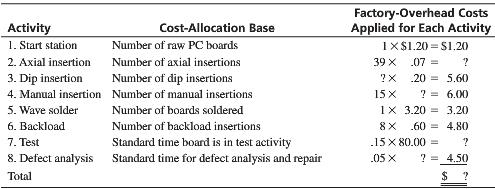

The activities involved in the production of PC board 37 and the related cost-allocation bases were as follows:

1. Fill in the numbers where there are question marks.

2. How is direct labor identified with products under this product-costing system?

3. Why would managers favor this multiple-overhead rate, ABC system instead of the older system?

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta