A financial regression analysis was carried out to estimate the linear relationship between long-term bond yields and

Question:

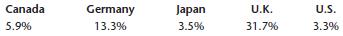

A financial regression analysis was carried out to estimate the linear relationship between long-term bond yields and the yield spread, a problem of significance in finance. The sample sizes were 242 monthly observations in each of five countries, and the results were the obtained regression r2 values for these countries. The results were as follows.

Assuming that all five linear regressions were statistically significant, comment on and interpret the reported r2 values.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Complete Business Statistics

ISBN: 9780077239695

7th Edition

Authors: Amir Aczel, Jayavel Sounderpandian

Question Posted: