A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: The

Question:

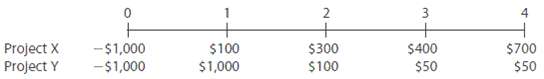

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows:

The projects are equally risky, and their WACC is 12%. What is the MIRR of the project that maximizes shareholdervalue?

Transcribed Image Text:

3 2 + $300 $100 Project X Project Y -$1,000 -$1,000 $100 $1,000 $400 $50 $700 $50

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (20 reviews)

Because both projects are the same size you can just calcu...View the full answer

Answered By

Rukhsar Ansari

I am professional Chartered accountant and hold Master degree in commerce. Number crunching is my favorite thing. I have teaching experience of various subjects both online and offline. I am online tutor on various online platform.

5.00+

4+ Reviews

17+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Corporate Finance questions

-

A manufacturing firm is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value . The initial cost and the net year-end revenue for...

-

A firm is considering two mutually exclusive projects, as follows. Determine which project should be accepted if the discount rate is 15 percent. Use the chain replication approach. Assume both...

-

A manufacturing firm is considering two mutually exclusive projects. Both projects have an economic service life of one year with no salvage value . The first cost of Project 1 is $1,000, and the...

-

The property is located at the intersection of two heavily traveled major arteries. It is a new, glass-walled, five-story office building containing 50,000 total square feet-40,000 of which is...

-

Bigco's balance sheet one year ago indicated retained earnings of $450 million. This year, Bigco's net income was $35 million. It paid its preferred shareholders a dividend of $5 million and paid its...

-

1. The alliance between Patagonia and Walmart is an excellent example of a small business and a large business working together to achieve an objective. Do you think the same results would be...

-

An equimolar stream of benzene and toluene at \(1,000 \mathrm{lbmol} / \mathrm{hr}\) and \(100^{\circ} \mathrm{F}\) is mixed with a toluene stream at \(402.3 \mathrm{lbmol} / \mathrm{hr}\) and...

-

Refer to Figure which shows the computer solution THE MANAGEMENT SCIENTIST SOLUTION FOR THE INVESTMENT ADVISORS PROBLEM a. How much would the return for U.S. Oil have to increase before it would be...

-

Calculate the ratio of the density at the centre of the Sun compared to the density of the photosphere. Density of Sun at the centre: 1.6 x 10 5 kg m -3 Density of the Sun in the photosphere: 2 x 10...

-

Constructing a distribution of demand during reorder lead time is complicated if the lead time itself is variable. Consider the following distribution for a reorder point inventory system. a. What is...

-

A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: The companys WACC is 10%. What is the IRR of the better project? (Hint: The better project may or may...

-

K. Kim Inc. must install a new air conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are...

-

Compute the specified ratios using Faustin Companys balance sheet for 2014. Assets Cash .............. $ 18,000 Marketable securities ......... 12,000 Accounts receivable ........ 25,000 Inventory...

-

What is the basic approach to cost allocation in a non-ABC system?

-

Have you had a chance to participate in an evaluation of an equipment purchase at your workplace? If so, would you have done it differently if you had supervised the evaluation? Why?

-

Why is law sometimes at odds with justice? Give an example.

-

Relate the rule of law to Packer's models of criminal justice.

-

Do any of the reports you receive in the course of your work use trend analysis? Why do you think so?

-

Istisnaa is a sales contract between a. Al-Mustasni and Al-Sani b. Al-Mustasni and Al-Masnoo c. Al-Mustasni and client d. Al-Sani and the manufacturer

-

You are thinking of investing in one of two companies. In one annual report, the auditors opinion states that the financial statements were prepared in accordance with generally accepted accounting...

-

A chemist knows that aluminum is more reactive toward oxygen than is iron, but many people believe the opposite. What evidence was provided in this chapter that demonstrates that aluminum is a much...

-

Austin Grocers recently reported the following 2008 income statement (in millions of dollars): Sales $700 Operating costs including depreciation 500 EBIT $200 Interest 40 EBT $160 Taxes (40%) 64 Net...

-

Walter Industries has $5 billion in sales and $1.7 billion in fixed assets. Currently, the companys fixed assets are operating at 90% of capacity. a. What level of sales could Walter Industries have...

-

Jasper Furnishings has $300 million in sales. The company expects that its sales will increase 12% this year. Jaspers CFO uses a simple linear regression to forecast the companys inventory level for...

-

Last year, a city had three school districts: North with a population of 5200 children, South with a population of 10600 children, West, with a population of 15100 children. Use Hamilton, Adams,...

-

Prepare the journal entry to record pension expense and the employer ? s contribution to the pension plan in 2 0 2 0 . ( Credit account titles are automatically indented when amount is entered. Do...

-

Concord Department Store uses a perpetual inventory system. Data for product E2-D2 include the following purchases. Date Number of Units Unit Cost May 7 July 28 45 30 $13 15 On June 1, Concord sold...

Study smarter with the SolutionInn App