(a) Harriet Pandel, an employer, is subject to FICA taxes but exempt from FUTA and SUTA taxes....

Question:

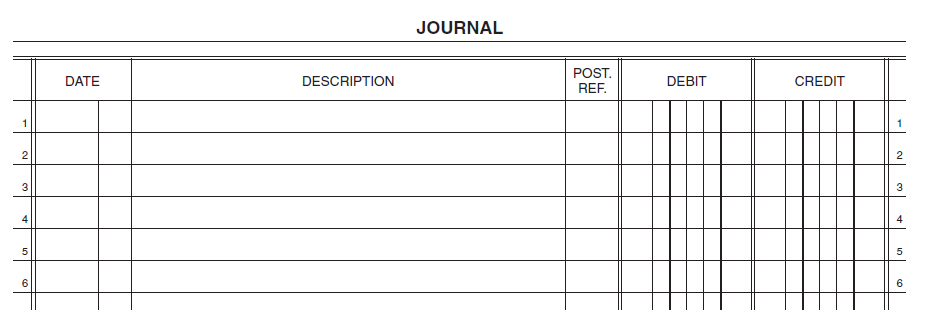

(a) Harriet Pandel, an employer, is subject to FICA taxes but exempt from FUTA and SUTA taxes. During the last quarter of the year, her employees earned monthly wages of $16,900, all of which is taxable. The amount of federal income taxes withheld each month is $1,698. Journalize the payment of wages, and record the payroll tax on November 29.

.png)

(b) Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable- HI, and Employees FIT Payable had zero balances.

Pandel must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: