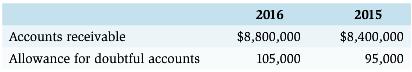

A large corporation recently reported the following amounts on its year-end statements of financial position: A footnote

Question:

A large corporation recently reported the following amounts on its year-end statements of financial position:

A footnote to these statements indicated that the company uses a percentage of its credit sales to determine its bad debts expense, that $60,000 of uncollectible accounts were written off during 2015 and $80,000 of uncollectible accounts were written off in 2016, and that there were no recoveries of accounts written off.

Required:

a. Determine the amount of bad debts expense that must have been recorded by the company for 2016.

b. How were the company€™s net receivables affected by the write-off of the $80,000 of accounts in 2016?

c. How was the company€™s net earnings affected by the $80,000 write-off of accounts in 2016?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 978-1118849385

1st Canadian Edition

Authors: Christopher Burnley, Robert Hoskin, Maureen Fizzell, Donald