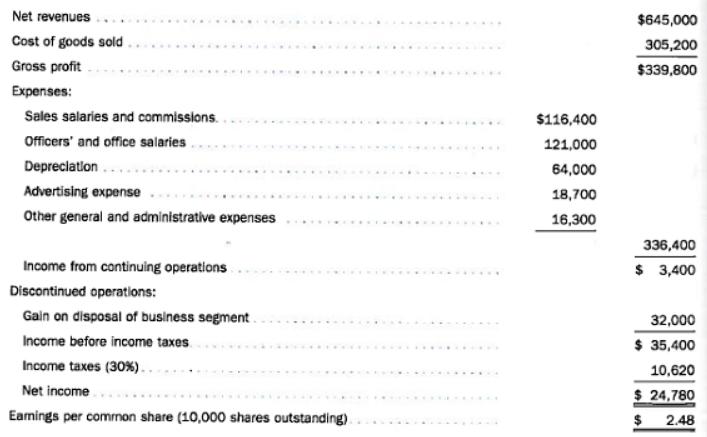

A newly hired staff accountant prepared the pre-audit income statement of Jericho Recreation Incorporated for the year

Question:

A newly hired staff accountant prepared the pre-audit income statement of Jericho Recreation Incorporated for the year ending December 31, 2008.

The following information was obtained by Jericho's independent auditor.

(a) Net revenues in the income statement included the following items.

Sales returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . .$ 9,500

Interest revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..... . . . . . 6,600

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... . . . . . . . 10,600

Loss on sale of short-term investment . . . . . . . . . . . . . .. . . . . . . 3,000

Extraordinary gain . . . . . . . . . . . . . . . . . . . . . . . . . . . ..... . . . . . . . 16,000

(b) Of the total depreciation expense reported in the income statement, 60% relates to stores and store equipment, 40% to office building and equipment.

(c) At the beginning of 2008, management decided to close one of Jericho's retail stores. Jericho is a large company and does not attempt to prepare complete financial reports for each individual store. The inventory and equipment were moved to another Jericho store, and the land and building were sold on July 1, 2008, at a pretax gain of $40,000. This amount has been reported under discontinued operations.

(d) The income tax rate is 30%.

Instructions:

Prepare a corrected multiple-step income statement for the year ended December 31,2008.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0324312140

16th Edition

Authors: James D. Stice, Earl K. Stice, Fred Skousen