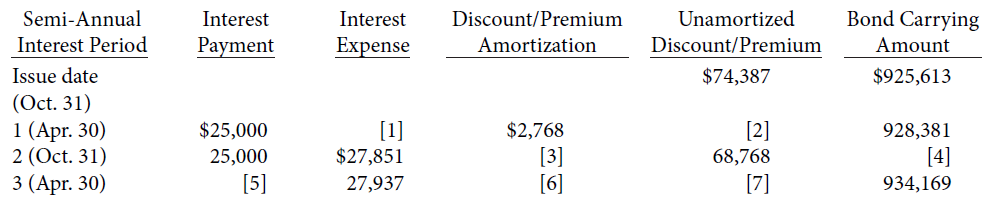

A partial bond amortization schedule follows for Hwee Corporation: Instructions (a) Fill in the missing amounts for

Question:

A partial bond amortization schedule follows for Hwee Corporation:

Instructions

(a) Fill in the missing amounts for items [1] to [7].

(b) What is the face value of the bonds?

(c) Were the bonds issued at a discount or at a premium?

(d) What is the coupon interest rate on the bonds? The market interest rate?

(e) Explain why interest expense is greater than interest paid.

(f) Explain why interest expense will increase each period.

(g) What will be the bonds' carrying amount on their maturity date?

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

Question Posted: