(a) What spot and forward rates are embedded in the following Treasury bonds? The price of one-year...

Question:

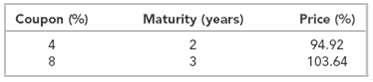

(a) What spot and forward rates are embedded in the following Treasury bonds? The price of one-year (zero-coupon) Treasury bills is 93.46 percent. Assume for simplicity that bonds make only annual payments. Can you devise a mixture of long and short positions in these bonds that gives a cash payoff only in year 2? In year 3?

(b) A three-year bond with a 4 percent coupon is selling at 95.00 percent. Is there a profit opportunity here? If so, how would you take advantage of it?

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted: