Activity-based costing, service company Quikprint Corporation owns a small printing press that prints leaflets, brochures, and advertising

Question:

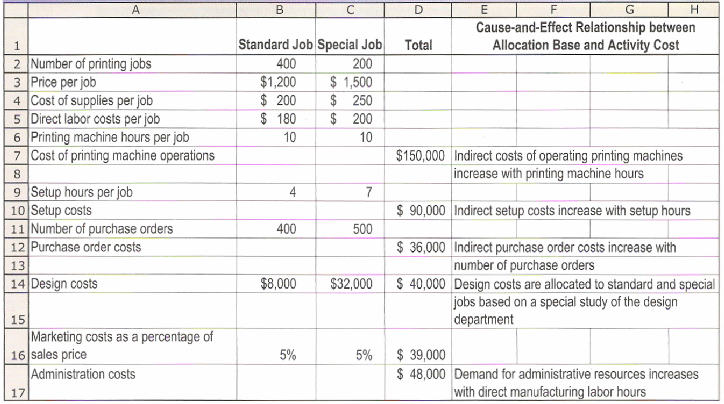

Activity-based costing, service company Quikprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Quikprint classifies its various printing jobs as standard jobs or special jobs. Quikprint’s simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Quikprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base.

Quikprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Quikprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs, Quikprint collects the following information for the fiscal year 2009 that just ended.

If you want to use Excel to solve this exercise, go to the Excel Lab at www.prenhall.com/horngren/cost13e and download the template for Exercise 5-21.

1. Calculate the cost of a standard job and a special job under the simple costing system.

2. Calculate the cost of a standard job and a special job under the activity-based costing system.

3. Compare the costs of a standard job and a special job in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job?

4. How might Quikprint use the new cost information from its activity-based costing system to better manage its business?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav