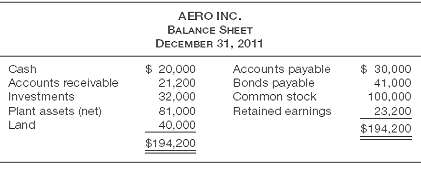

Aero Inc. had the following balance sheet at December 31, 2011. During 2012, the following occurred.1. Aero

Question:

Aero Inc. had the following balance sheet at December 31, 2011.

During 2012, the following occurred.1. Aero liquidated its available-for-sale investment portfolio at a loss of $5,000.2. A tract of land was purchased for $38,000.3. An additional $30,000 in common stock was issued at par.4. Dividends totaling $10,000 were declared and paid to stockholders.5. Net income for 2012 was $35,000, including $12,000 in depreciation expense.6. Land was purchased through the issuance of $30,000 in additional bonds.7. At December 31, 2012, Cash was $70,200, Accounts Receivable was $42,000, and Accounts Payable was $40,000.Instructions(a) Prepare a statement of cash flows for the year 2012 for Aero.(b) Prepare the balance sheet as it would appear at December 31, 2012.(c) Compute Aero's free cash flow and the current cash debt coverage ratio for 2012.(d) Use the analysis of Aero to illustrate how information in the balance sheet and statement of cash flows helps the user of the financialstatements.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: