After graduating last year from an Ivy League university, Joe Tyler was hired as a stock analyst.

Question:

After graduating last year from an Ivy League university, Joe Tyler was hired as a stock analyst. Wanting to make his mark on the industry, Tyler issued a scathing report on a major discount department store retailer, Smart-Mart. The basis of his attack was a comparative analysis between Smart-Mart and Tracy's Department Store, an upscale, full-service department store.

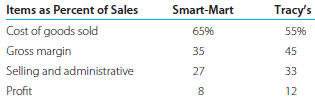

Some of the information cited in Tyler's report follows.

Based on the comparative analysis, Tyler issued to his clients a "sell" recommendation for Smart-Mart and a "buy" recommendation for Tracy's. The gist of Tyler's rationale for the recommendations was that Tracy's Department Store was outperforming Smart-Mart in the crucial area of cost management as evidenced by both a higher profit as a percent of sales and a higher gross margin as a percent of sales.

a. Evaluate Tyler's recommendations given the limited evidence available.

b. Because the two firms contrasted by Tyler have different strategies, what performance criteria would you use to evaluate their competitiveness in the industry?

Step by Step Answer:

Cost Accounting Foundations and Evolutions

ISBN: 978-1111626822

8th Edition

Authors: Michael R. Kinney, Cecily A. Raiborn