Ahron Company makes 80,000 units per year of a part it uses in the products it manufactures.

Question:

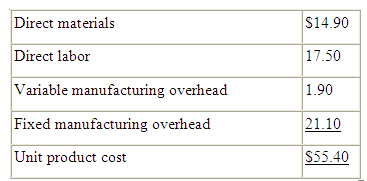

Ahron Company makes 80,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $46.60 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $560,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $13.60 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 80,000 units required each year?

1. $7.00

2. $55.40

3. $62.40

4. $48.80

Contribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello