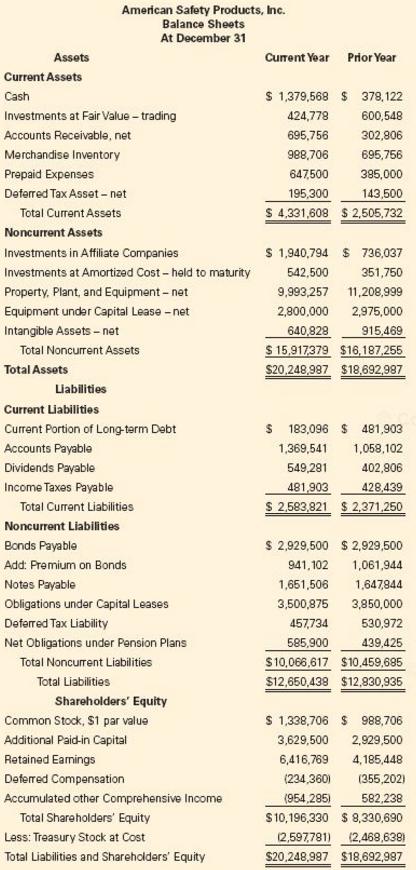

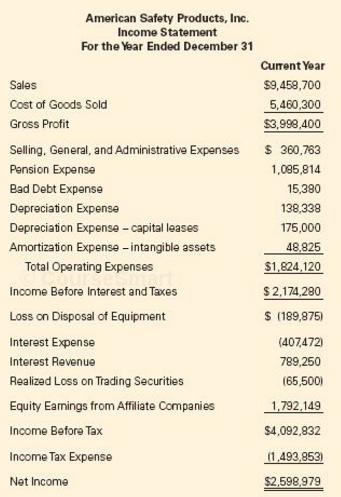

American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year.

Question:

American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year.

Additional Information:

1. American Safety Products sold trading securities at a loss.

2. The company sold one of its franchises at cost.

3. American Safety Products sold plant assets with a carrying value of $ 1,077,404 for a loss of $ 189,875.

4. American Safety Products made debt payments to reduce the current portion of long- term debt and capital lease obligations. American Safety Products borrowed an additional $ 3,662 by issuing a long-term note.

5. The change in AO CI is due to adjustments required for the company’s defined- benefit pension plan.

6. American Safety Products acquired additional securities classified as held to maturity. It did not purchase any other investments during the year.

7. American Safety Products did not reissue any treasury stock

8. Treat the trading securities as an investing activity. 9. Ignore the amortization of the held- to- maturity investment.

Required

Prepare the cash flow statement for American Safety Products for the current year using the indirect method. Provide all required disclosures.

American Safety Products, Inc. Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value trading Accounts Receivable, net Merchandise Inventory Prepaid Expenses Deferred Tax Asset- net S 1,379,568 S 378,122 424,77 600,548 65,758 30 306 988,706 695,756 647500 385,000 95,300 143,500 S 4,331,608 2,505,732 Total Current Assets Noncurrent Assets Investments in Affiliate Companies Investments at Amortized Cost held to maturity Property, Plant, and Equipment net Equipment under Capital Lease -net Intangible Assets-net S 1,940,794 736,037 351,750 542,500 9,893,257 11,20,9e 2.800,000 2.975,000 40,828915459 Total Noncurrent Assets Total Assets S20.248.997 $18.692.987 Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Dividends Payable Income Taxes Payable S 183,096 481,903 1,369,541 1,058,102 549281 402,806 481.903428439 Total Current Liabilities Noncurrent Liabilities Bonds Payable Add: Premium on Bonds S 2,583,821 $2,371,250 s 2,929,500 2,929,500 941.102 ,061,944 1,651,506 1,647844 3,500,875 3,850,000 457,734 530,972 439,425 $10,066,617 $10,459,685 $12,650,438 $12.,830,935 Obligations under Capital Leases Deferred Tax Liability Net Obligations under Pension Plans Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Deferred Compensation Accumulated other Comprehensive Income S 1,338,706 S 988,706 3,629,500 2,929,500 6,416,769 4,185,448 234,360 (355,202) 954,285) 582,238 S10,196,330 $ 8,330,690 口597781) 12,468,6381 S20.248.987 $18,692,987 Total Shareholders' Equity Less: Treasury Stock at Cost Total Liabilities and Shareholders Equity American Safety Products, Inc. Income Statement For the Year Ended December 31 Sales Cost of Goods Sold Gross Profit Current Year 59,458,700 5,460,300 $3,998.400 Selling, General, and Administrative Expenses 360,763 1,085,814 15,380 138,338 175,000 48,825 $1,824.120 2,174,280 S (189.878 407472 789,250 65,500 1,792,149 $4,092,832 1,493,853) $2,598,979 Pension Expense Bad Debt Expense Depreciation Expense Depreciation Expense capital leases Amortization Expense -intangible assets Total Operating Expenses Income Before Interest and Taxes Loss on Disposal of Equipment Interest Expense Interest Revenue Realized Loss on Trading Securities Equity Earmings from Affiliate Companies Income Before Tax Income Tax Expense Net Income

Step by Step Answer:

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset...View the full answer

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Students also viewed these Accounting questions

-

Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method. In P22-13 American Safety Products, Inc....

-

Ferragosto Services, Ltd. provided the following comparative balance sheets and income statement for the current year. Ferragosto Services, Ltd. Income Statement For the Year Ended December, 31...

-

Using the information provided in E22-12, prepare the statement of cash flows for Ferragosto Services, Ltd. under the direct method. In E22-12 Ferragosto Services, Ltd. provided the following...

-

Arvind runs a small electronics company in India and has just sold some equipment to a U.S. company for $1 million to be paid in 90 days. His cost in Indian Rupees (INR) is 60 million. The current...

-

Using Table 6.6, what is your best guess about the current price of gold per ounce? Explain with detail.

-

Gordon Supply Company manufactures high quality gardening supplies for sale primarily to nursery and landscaping companies. Gordon Supply is a business that has continued to grow because of its...

-

For each of the following, calculate the degrees of freedom \((d f)\) and determine the critical values of \(t\) (assume \(\mathrm{a}=.05\) ). a. N =21, N2 = 21, H: H H1 H1* H2 b. N 14, N = 14, H1 H1...

-

A partial adjusted trial balance of Frangesch Company at January 31, 2017, shows the following. Instructions Answer the following questions, assuming the year begins January 1. a) If the amount in...

-

SHA E SI SINE THIS IS A TEST ASYL "NASA completed a record-breaking experiment last week, and it involved streaming an adorable cat video from 19 million miles away (about 80 times the distance...

-

A Global private bank is aggressively looking to leverage technology to improve customer experience and reduce operational costs. Over the last few years, it has tied up with at least five startups...

-

Prepare the cash flow statement and all required disclosures for Barrys Clothing Stores, Inc. from P22-11 using the direct method. In P22-11 Barrys Clothing Stores, Inc. released its annual report...

-

Repeat the requirements of P22-1 under the indirect method. In P22-1 Shark Company provided the following balance sheet and income statement for the current year. Prepare the operating activities...

-

How many times will the following code print out the message? for x in range (0,3): for y in range (1,5): print "I wil1 be good"

-

1. reference: Freedom of contract. Obligations arising from contracts can be enforced between the contracting parties provided such contract is not contrary to law. Although the contracting parties...

-

find all digested cases of Criminal law 1 and Constitutional Law 1, Persons and Family relations and all related topics on this subjects?

-

Define instrumental and structural theories as part of the institution of socialization. Explain why theorists continue a debate of rich versus poor families and individuals with respect to laws and...

-

the court has designated Marie the primary parent and that David has shared parenting time of all three children every other weekend and for five weeks during the summer months, for a total of 121...

-

Procurement plan of a barn construction: this plan should identify the types of external resources that must be secured, the process for selecting and managing these external resources and the...

-

Estimate the intervals where the graph of f is concave upward and where the graph is concave downward. Use interval notation. y 3 2 1. -3 23

-

Refer to the data in QS 10-1. Based on financial considerations alone, should Helix accept this order at the special price? Explain.

-

Installment-Sales Computation and Entries'Periodic Inventory Mantle Inc. sells merchandise for cash and also on the installment plan. Entries to record cost of goods sold are made at the end of each...

-

Installment Repossession Entries selected transactions of TV Land Company are presented below. 1. A television set costing $540 is sold to Jack Matre on November 1, 2010, for $900. Matre makes a down...

-

Installment-Sales Computations and Schedules Saprano Company, on January 2, 2010, entered into a contract with a manufacturing company to purchase room-size air conditioners and to sell the units on...

-

Explain how the OS and Utility programs work with application software. Summarize the features of several embedded operating systems course: introduction to information technology code: EBI...

-

Please explain and describe what are input and output devices. Explain what the differences are between an operating system, an embedded operating system, and a network operating system. Explain and...

-

Determine the complexity of the following pseudocode snippets in Big-O and Big-Q2. Do these code snippets have a Big-e? What are the functions doing? 1) my_func(some_nums) result = 0 for (num in...

Study smarter with the SolutionInn App