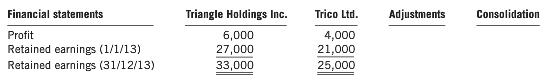

An extract from the consolidated statement of Triangle Holdings Inc. and its subsidiary, Trico Ltd., as at

Question:

An extract from the consolidated statement of Triangle Holdings Inc. and its subsidiary, Trico Ltd., as at

December 31, 2013, is shown below.

Triangle Holdings acquired all the share capital (cum div.) of Trico on January 1, 2013, for $127,000 when Trico€™s equity consisted of:

Share capital .............$85,000

Retained earnings............. 21,000

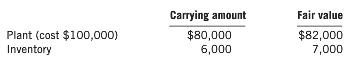

All the identiï¬able assets and liabilities of Trico at January 1, 2013, were recorded at fair value except for:

Triangle Holdings acquired all the share capital (cum div.) of Trico on January 1, 2013, for $127,000 when Trico€™s equity consisted of:

Share capital............. $85,000

Retained earnings............. 21,000

All the identiï¬able assets and liabilities of Trico at January 1, 2013, were recorded at fair value except for:

The plant had a further six-year life. All the inventory was sold by Trico by September 22, 2013. The tax rate is 40%.

Trico€™s liabilities included a dividend payable of $6,000. Trico had not recorded any goodwill. At January 1, 2013, Trico had incurred research and development outlays of $5,000, which it had expensed. Triangle Holdings placed a fair value of $2,000 on this item. The project was still in progress at December 31, 2013, with Trico capitalizing $3,000 in 2013.

Required

(a) Prepare the consolidation process adjustments at December 31, 2013.

(b) Complete the consolidated ï¬nancial statement extract above.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: