Ancala Corporation is considering investments in two new golf apparel lines for next season: golf hats and

Question:

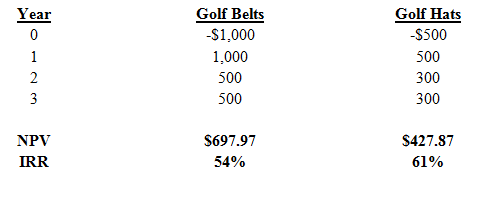

Ancala Corporation is considering investments in two new golf apparel lines for next season: golf hats and belts. Due to a funding constraint, these lines are mutually exclusive. A summary of each project’s estimated cash flows over its three-year life, as well as the IRR and NPV of each, are outlined below. The CFO of the firm has decided to manufacture the belts; however, the CEO is questioning this decision given that the IRR is higher for manufacturing hats. Explain to the CEO why the IRRs and NPVs of the belt and hat projects disagree? Is the CFO’s decision correct?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of corporate finance

ISBN: 978-0470876442

2nd Edition

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

Question Posted: