Annandale, Inc., produces and sells wireless reading devices. A competitor, Danube Electronic Products, sells similar wireless reading

Question:

Annandale, Inc., produces and sells wireless reading devices. A competitor, Danube Electronic Products, sells similar wireless reading devices that it purchases at wholesale from Sonex

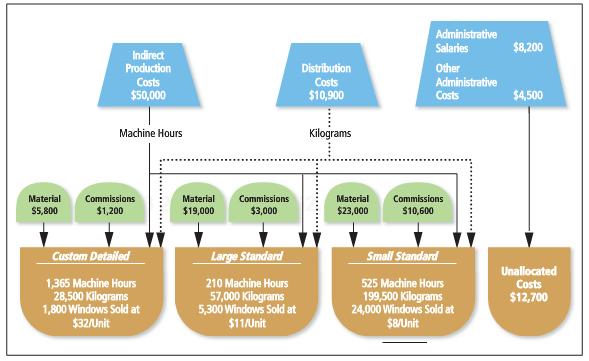

Exhibit 4-17

Process Map for Penguin Window Company’s Traditional Cost Allocation System

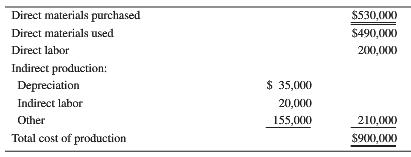

For $75 each. Both sell the devices for $180. In 20X9 Annandale produced 12,000 devices at the following costs:

Assume that Annandale had no beginning inventory of direct materials. Neither company had any beginning inventory of finished devices, but both had ending inventory of 2,500 finished devices. Ending work-in-process inventory for Annandale was negligible.

Each company sold 9,500 devices for $1,710,000 in 20X9 and incurred the following selling and administrative costs:

Sales salaries and commissions …….. $110,000

Depreciation on retail store …………….. 45,000

Advertising …………………………….. 10,000

Other …………………………………….. 5,000

Total selling and administrative cost … $170,000

1. Prepare the inventories section of the balance sheet for December 31, 20X9, for Danube.

2. Prepare the inventories section of the balance sheet for December 31, 20X9, for Annandale.

3. Using the cost of goods sold format on page 134 as a model, prepare an income statement for the year 20X9 for Danube.

4. Using the cost of goods sold format on page 134 as a model, prepare an income statement for the year 20X9 for Annandale.

5. Summarize the differences between the financial statements of Danube, a merchandiser, and Annandale, a manufacturer.

6. What purpose of a cost management system is being served by reporting the items in requirements 1–4?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta