As a new credit trainee for Evergreen National Bank, you have been asked to evaluate the financial

Question:

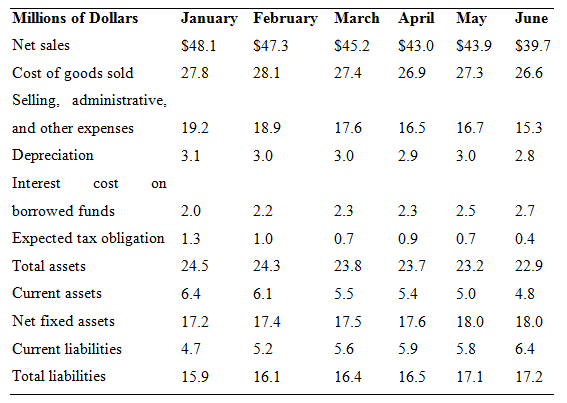

As a new credit trainee for Evergreen National Bank, you have been asked to evaluate the financial position of Hamilton Steel Castings, which has asked for renewal of and an increase in its six-month credit line. Hamilton now requests a $7 million credit line, and you must draft your first credit opinion for a senior credit analyst. Unfortunately, Hamilton just changed management, and its financial report for the last six months was not only late but also garbled. As best as you can tell, its sales, assets, operating expenses, and liabilities for the six-month period just concluded display the following patterns:

Hamilton has a 16-year relationship with the bank and has routinely received and paid off a credit line of $4 million to $5 million. The department’s senior analyst tells you to prepare because you will be asked for your opinion of this loan request (though you have been led to believe the loan will be approved anyway, because Hamilton’s president serves on Evergreen’s board of directors).

What will you recommend if asked? Is there any reason to question the latest data supplied by this customer? If this loan request is granted, what do you think the customer will do with the funds?

Step by Step Answer:

Bank Management and Financial Services

ISBN: 978-0078034671

9th edition

Authors: Peter Rose, Sylvia Hudgins