As a senior loan officer at MC Financial Corp, you have a loan application from a firm

Question:

1. Concentration Limits—The FI currently has lent an amount equal to 40 percent of its capital to the biotech industry and does not lend to a firm in any sector that generates losses in excess of 2 percent of capital. The average historical losses in the biotech industry total 5 percent.

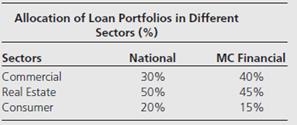

2. Loan Volume–Based Model—National and MC Financial’s loan portfolio allocations are as follows.

MC Financial does not want to deviate from the national average by more than 12.25 percent.

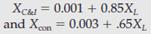

3. Loan Loss Ratio–Based Model—Based on regression analysis on historical loan losses, the FI estimates the following loan loss ratio models:

where XC&I = loss rate in the commercial sector, Xcon = loss rate in the consumer (household) sector, XL = loss rate for its total loan portfolio. MC Financial’s total increase in the loan loss ratio is expected to be 12 percent next year. Should MC Financial Corp. grant this loan?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 978-0071051590

8th edition

Authors: Marcia Cornett, Patricia McGraw, Anthony Saunders