As discussed in Item 1 of Nikes 10-K, one of the companies it owns is Cole Haan.

Question:

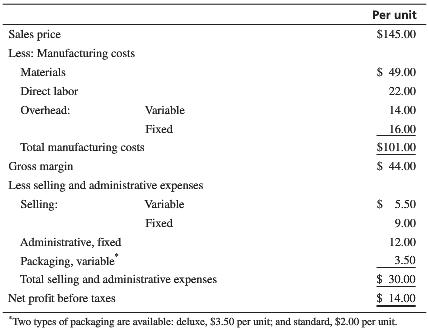

As discussed in Item 1 of Nike’s 10-K, one of the companies it owns is Cole Haan. Cole Haan makes a variety of fashion footwear, such as dress shoes. One of these products is a men’s loafer. This shoe is in strong demand. Suppose sales on this loafer during the present year, 20X0, are expected to hit the 1,000,000 mark. Full plant capacity is 1,150,000 units, but the 1,000,000-unit mark is considered normal capacity. The following unit price and cost breakdown is applicable in 20X0:

During March, the company received two special-order requests from Nordstrom and Macy’s. These orders are not part of the budgeted 1,000,000-unit sales for 20X0, but there is sufficient capacity for possibly one order to be accepted. Orders received and their terms are as follows:

Order from Nordstrom: 75,000 loafers at $136.00 per unit, deluxe packaging

Order from Macy’s: 90,000 loafers at $130.00 per unit, standard packaging

Since these orders were made directly to Cole Haan, no variable selling costs will be incurred.

1. Analyze the profitability of each of these two special orders. Which special order should be accepted?

2. What other aspects need to be considered in addition to profitability?

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta