As stated in the chapter, annuity payments are assumed to come at the end of each payment

Question:

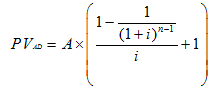

As stated in the chapter, annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). However, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). To find the present value of an annuity due, subtract 1 from n and add 1 to the tabular value. To find the present value of an annuity due, the annuity formula must be adjusted as to the following:

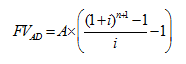

Likewise, the formula for the future value of an annuity due requires a modification:

What is the future value of a 15-year annuity of $1,800 per period where payments come at the beginning of each period? The interest rate is 12 percent.

AnnuityAn annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,... Future Value

Future value (FV) is the value of a current asset at a future date based on an assumed rate of growth. The future value (FV) is important to investors and financial planners as they use it to estimate how much an investment made today will be worth...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259277160

16th edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen