Assad Company bought an asset for $400,000 on January 1, 20X0. The asset has a 10-year life

Question:

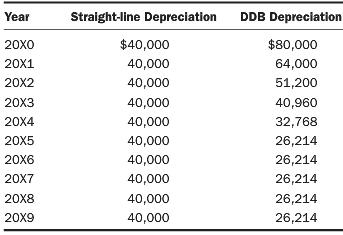

Assad Company bought an asset for $400,000 on January 1, 20X0. The asset has a 10-year life and zero salvage value for both financial reporting and tax purposes. Assad uses straight-line depreciation for financial reporting purposes and DDB depreciation for tax purposes. The DDB schedule switches to straight-line depreciation for the remaining book value when the resulting straight-line depreciation exceeds the amount of depreciation on the original DDB schedule. This results in the following depreciation charges:

The company’s tax rate is 40%.

1. Compute the amount in the deferred tax account at the end of each year.

2. Is the deferred tax account an asset or a liability? Explain.

3. What is the amount in the deferred tax account at the end of the life of the asset? Explain what caused the deferred tax account to reach this value at the end of the asset’s life.

4. Suppose that in 20X1, the company earns $80,000 before considering depreciation charges and depreciation is the only source of either permanent or timing differences for tax purposes. Compute the tax provision and the amount of current tax due to the government.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Introduction to Financial Accounting

ISBN: 978-0133251036

11th edition

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick