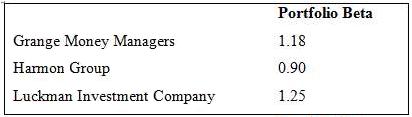

Assume a second firm that evaluates portfolios uses the Treynor approach to measuring performance. The firm is

Question:

a. Using the Treynor approach, how would the second firm rank the three portfolios? (Round to three places to the right of the decimal point.)

b. Explain why any differences have taken place in the rankings between problems 1 and 2a .

c. If the Treynor approach is utilized and the market return is 10 percent (with a risk-free rate of 7 percent), which of the portfolios outperformed the market? The market beta is always 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investment Management

ISBN: 978-0078034626

10th edition

Authors: Geoffrey Hirt, Stanley Block

Question Posted: