Assume that the auditor is auditing accounts receivable for a long-time client. The auditor has assessed the

Question:

Assume that the auditor is auditing accounts receivable for a long-time client. The auditor has assessed the risk of incorrect acceptance at 10%. The client's book value in accounts receivable is $8,425,000. Tolerable misstatement is $200,000, and expected misstatement is $40,000. Therefore, the ratio of expected to tolerable misstatement is 20%. The ratio of tolerable misstatement to the population book value is 2.4%.

a. Calculate the sample size and sampling interval.

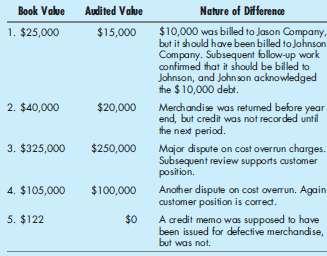

b. Analyze each difference detected during the audit to determine if it is a misstatement.

c. Calculate the total estimated misstatement assuming the misstatements detailed in the following table were found in the sample. Identify the top-stratum items, the lower-stratum items, and tainting percentages, where applicable. What conclusion do you reach based upon your calculation?

d. Discuss the audit implications, that is, whether the audit work supports book value or whether additional auditing procedures should be recommended, and, if so, describe the nature of the recommended auditing procedures.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Auditing a risk based approach to conducting a quality audit

ISBN: 978-1133939153

9th edition

Authors: Karla Johnstone, Audrey Gramling, Larry Rittenberg