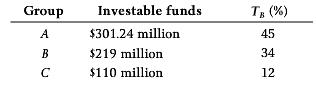

Assume that there are three groups of investors with the following tax rates on interest income: The

Question:

Assume that there are three groups of investors with the following tax rates on interest income:

The required rate of return after corporate tax on all-equity financed projects is 9.1 percent. The only types of securities available are common stock and corporate bonds. Capital gains and dividends are untaxed at the personal level. Corporate EBIT totals $85 million per year in perpetuity. The corporate tax rate is 39 percent. Assume all debt is risk free.

a. What is the equilibrium interest rate?

b. In equilibrium, will each group invest in debt or equity?

c. What is the market value of all companies?

d. What is the total tax bill?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer:

Corporate Finance

ISBN: 978-0071339575

7th Canadian Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Ro