At January 1, 2013, Berke Ltd. acquired all the shares of Tauber Ltd. for $283,000. At this

Question:

At January 1, 2013, Berke Ltd. acquired all the shares of Tauber Ltd. for $283,000. At this date the equity of Tauber consisted of:

Share capital€”100,000 shares ...$200,000

Retained earnings........ 70,000

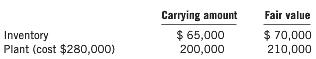

All of Tauber€™s identiï¬able assets and liabilities were recorded at amounts equal to fair value except for the following assets:

The inventory was all sold by June 30, 2013. The plant has a further ï¬ve-year life, and depreciation is calculated on a straight-line basis.

The tax rate is 40%.

Required

(a) Prepare the acquisition analysis at January 1, 2013.

(b) Calculate the fair value adjustments for 2013.

Transcribed Image Text:

Carrying amount Inventory Plant (cost $280,000) $65,000 200,000 Fair value $70,000 210,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

a BERKE LTD TAUBER LTD Acquisition analysis at January 1 2013 Consideration transferred 283000 Fair value of identifiable assets and liabilities of Ta...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

On 1 July 2017, Pacific Ltd acquired all the shares of Ascot Ltd for $5,000,000. The equity of Ascot Ltd at 1 July 2016 was: Share capital $3,400,000 Retained earnings $680,000 General reserve...

-

On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £6,000 cash. The fair value of the net assets in Daughter Ltd was their book value. Required: Prepare the...

-

On 1 July 2023, Gordon Ltd acquired all the issued shares (cum div.) of Henry Ltd for $528000. At that date, the financial statements of Henry Ltd showed the following information. Share capital...

-

The following recreation demand function is for a beach: x = 4 (p/500) + q. The visitation amount is represented by x (times), the travel cost is represented by p (yen), and the water quality is...

-

Jim owns 80% of Gold Corporation stock. He transfers a business automobile to Gold in exchange for additional Gold stock worth $5,000 and Golds assumption of both his $1,000 automobile debt and his...

-

For the self-bias configuration of Fig. 7.95, determine: a. IDQ and VGSQ. b. VDS and VD. 14 V 1.2 k Do as DSS 6 mA 0 1 0.43 k

-

Explain why rotation (change) of the lead auditor is important.

-

1. What was the most important reason for Lehman Brothers failure? 2. What is leverage and why is it so important? 3. Prepare the journal entries for a Repo 105 transaction sequence for $1 million in...

-

16. Let a1, a2, 17. a <0 is: (a) 22 be in H.P. with a = 5 and a20 = 25. The least positive integer n for which " (b) 23 Sum of the series rlog. r=1 (c) 24 (d) 25 r+1 + is: r

-

An ideal Carnot engine operates between 500 o C and 100 o C with a heat input of 250 J per cycle. (a) How much heat is delivered to the cold reservoir in each cycle? (b) What minimum number of cycles...

-

On January 1, 2013, Sculptor Ltd. acquired all the share capital (cum div.) of Virgo Ltd., giving in exchange 50,000 shares in Sculptor, with a fair value at acquisition date of $5 per share. The...

-

Retic Ltd. acquired 100% of the share capital of Dorado Ltd. for $102,000 on January 1, 2011, when the equity of Dorado consisted of: Share capital50,000 shares........ $50,000 Retained earnings...

-

When is a principal liable for the agents actions with respect to third parties? When is the agent liable?

-

Using a spherical coordinate system, show that the moment of inertia of a solid sphere of radius \(R\) and mass \(M\) with respect to any diameter passing through the center is \(\frac{2}{5} M...

-

A bicycle wheel of diameter \(D=26\) inches \((1\) inch \(=2.54 \mathrm{~cm})\) is rotating with frequency \(f=1.0 \mathrm{~s}^{-1}\). Neglecting finite size and tire deformation, assuming the wheel...

-

A yo-yo consists of a homogeneous slotted cylinder, radius \(R=7.0 \mathrm{~cm}\) and mass \(\mathrm{m}=100 \mathrm{~g}\). The inner slot is of negligible width, and does not significantly affect the...

-

A simple pendulum serves as a device for estimating wind speed. A small ball of mass \(m=100\) \(\mathrm{g}\) hangs from the end of the pendulum of length \(l=1 \mathrm{~m}\). Blow the wind in a...

-

Show that the moment of inertia for an axis perpendicular to the conjunction of a system of two bodies \(m_{1}, m_{2}\) spaced \(r\) apart and passing through C.M. is \(J=\mu r^{2}\), where \(\mu\)...

-

Find the shaded area in each of the following circles with centre C. a C 4 cm 4 cm b 0.2 rad 5 cm C

-

Suppose that A is an m n matrix with linearly independent columns and the linear system LS(A, b) is consistent. Show that this system has a unique solution.

-

How does an expenditure differ from an expense? Identify the funds that report expenditures and those that report expenses.

-

What are the three sections of a CAFR? Briefly identify the contents of each section.

-

What are the three sections of a CAFR? Briefly identify the contents of each section.

-

Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units...

-

Starting next year you plan on saving for a trip 10 years from now. You plan to save a $1000 a year from year 1 to year 9 because in year 10 there is no point in putting money away if you are going...

-

Write a C++ program to implement a stack using linked lists and provide functions for push, pop, and peek operations.

Study smarter with the SolutionInn App