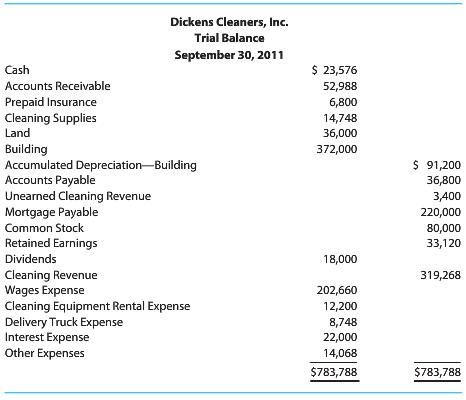

At the end of its fiscal year, Dickens Cleaners, Inc., had the following trial balance: The following

Question:

At the end of its fiscal year, Dickens Cleaners, Inc., had the following trial balance:

The following information is also available:

a. A study of the company’s insurance policies shows that $1,360 is unexpired at the end of the year.

b. An inventory of cleaning supplies shows $2,300 on hand.

c. Estimated depreciation on the building for the year is $25,600.

d. Accrued interest on the mortgage payable is $2,000.

e. On September 1, the company signed a contract, effective immediately, with Kings County Hospital to dry-clean, for a fixed monthly charge of $850, the uniforms used by doctors in surgery. The hospital paid for four months’ service in advance.

f. The company pays sales and delivery wages on Saturday. The weekly payroll is $6,120. September 30 falls on a Thursday, and the company has a six-day pay week.

g. Estimated federal income taxes for the period are $4,600.

REQUIRED

All adjustments affect one balance sheet account and one income statement account. For each of the above situations, show the accounts affected, the amount of the adjustment (using a + or – to indicate an increase or a decrease, respectively), and the balance of the account after the adjustment in the following format:

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: