Atlas Company has long-term debt on its books. It has issued new debt and made payments on

Question:

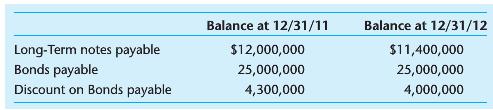

Atlas Company has long-term debt on its books. It has issued new debt and made payments on the outstanding debt every year. The ending balance in the accounts for the current year and the prior year follow.

a. Assume that $3,000,000 of new long-term notes payable was issued in 2012.

What is the amount of notes paid during the year? Show your calculations.

b. Why has the balance in the Discount on Bonds Payable changed from 2011 to 2012, but the bonds' face value has not?

c. The company's current ratio should be maintained at no less than 1.0 during the entire year according to the debt covenant on the new note payable.

How will the auditors determine whether that condition has been met in 2012?

d. The Bonds Payable account contains two debt covenants. The first covenant requires the company to cancel all management bonuses if the debt-to-equity ratio goes above 0.50. The second covenant permits the company to issue stock options only if net income increases by 20% per year. How will the auditors determine whether the company has met the debt covenants in 2012?

e. Why have the bond holders included these particular debt covenants in their debt agreement? What do they hope to gain from the covenants?

f. Describe assertions that could be important for the Long-Term Debt account, and describe one substantive test you could use to verify that the assertions are valid.

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Auditing and Assurance Services An Applied Approach

ISBN: 978-0073404004

1st edition

Authors: Iris Stuart