Backflushing. The following conversation occurred between Brian Richardson, plant manager at Glendale Engineering, and Charles Cheng, plant

Question:

Backflushing. The following conversation occurred between Brian Richardson, plant manager at Glendale Engineering, and Charles Cheng, plant controller. Glendale manufactures automotive component parts, such as gears and crankshafts, for automobile manufacturers. Richardson has been very enthusiastic about implementing JIT and about simplifying and streamlining production and other business processes. “Charles,” Richardson began, - I would like to substantially simplify our accounting in the new JIT environment. Can’t we just record one journal entry at the time we ship products to our customers? I don’t want to have our staff spending time tracking inventory from one stage to the next when we have as little inventory as we do.” “Brian,” Cheng said, “I think you are right about simplifying the accounting, but we still have a fair amount of direct materials and finished goods inventory that varies from period to period, depending on the demand for specific products. Doing away with all inventory accounting may be a problem.” “Well,” Richardson replied, “you know my desire to simplify, simplify, simplify. I know that there are some costs of oversimplifying, but I believe that in the long run, simplification pays dividends. Why don’t you and your staff study the issues involved, and I will put it on the agenda for our next management meeting.”

1. What version of backflush costing would you recommend that Cheng adopt? Remember Richardson’s desire to simplify the accounting as much as possible. Develop support for your recommendation.

2. Think about the three versions of backflush costing shown in Exhibit 20-8. These versions differ with respect to the number and types of trigger points used, Suppose your goal of implementing back- flush costing is to simplify the accounting, but only if it closely matches the sequential-tracking approach. Which version of backflush costing would you propose if:

a. Glendale had no direct materials and no work-in-process inventories but did have finished goods inventory?

b. Glendale had no work in process and no finished goods inventories but did have direct materials inventory?

c. Glendale had no direct materials, no work-in-process, and no finished goods inventories?

3. Backflush costing has its critics. In an article in the magazine Management Accounting titled “Beware of the New Accounting Myths,” R. Calvasina, E. Calvasina, and 0. Calvasina state:

The periodic (backflush) system has never been reflective of the reporting needs of a manufacturing system. In the highly standardized operating environments of the present JIT era, the appropriate system to be used is a perpetual accounting system based on an up-to-date, realistic set of standard costs. For management accountants to backflush on an actual cost basis is to return to the days of the outdoor privy (toilet).

Comment on this statement.

EXHIBIT 20-8

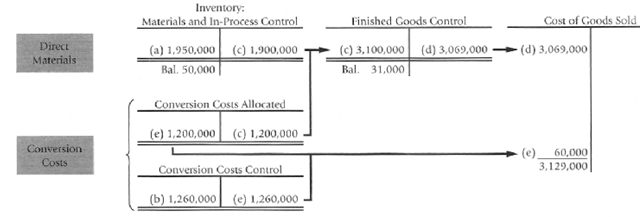

PANEL A, EXAMPLE 1: Three Trigger Points—Purchase of Direct Materials. Completion of Finished Goods, and Sale of Finished Goods

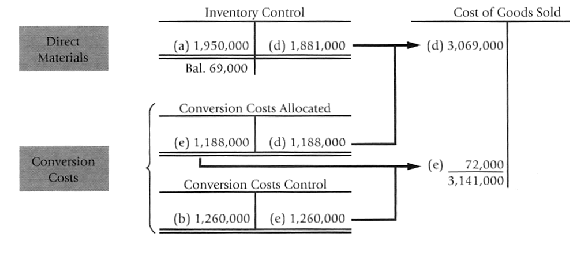

PANEL, EXAMPLE 2: Two Trigger Points—Purchase of Direct Materials and Sale of Finished Goods

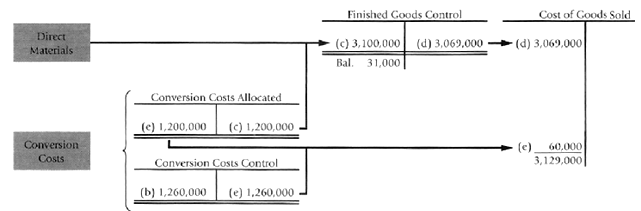

PANEL C, EXAMPLE 3: Two Trigger Points—Completion of Finished Goods and Sale of Finished Goods

sold X $31 per unit = $3,069,000, which is composed of direct material costs (99,000 units X $19 per unit = $1,881,000) and conversion costs allocated (99,000 units X $12 per unit $1,188,000).

No conversion costs are inventoried. That is, compared with Example 1, Example 2 does not assign $12,000 ($12 per unit X 1,000 units) of conversion costs to finished goods inventory. Hence, Example 2 allocates $12,000 less in conversion costs to inventory relative to the conversion costs allocated to inventory in Example 1. Of the $1,260,000 in conversion costs, $1,188,000 is allocated at standard cost to the units sold. The remaining $72,000 ($1,260,000 Exhibit 20-7, Panel B, presents the journal entry if SVC, like many companies, writes off these underallocated costs monthly as additions to cost of goods sold.

The April 30 ending balance of Inventory Control is $69,000 ($50,000 direct materials still on hand + $19,000 direct materials embodied in the 1,000 units manufactured but not sold during the period). Exhibit 20-8, Panel B, provides a general-ledger overview of this version of backflush costing. Entries are keyed to Exhibit 20-7, Panel B. The approach described in Example 2 closely approximates the costs computed using sequential tracking when a company holds minimal work-in-process and finished goods inventories. Example 3: Trigger points are completion of good finished units of product (stage C) and sale of finished goods (stage D) This example has two trigger points. Exhibit 20-7, Panel C, presents the journal entries. In contrast to Example 2, the first trigger point in Example 3 is delayed until stage C, SVC’s completion of good finished units of product. It is represented by transaction (c). Because the purchase of direct materials is not a trigger point, there is no entry corresponding to transaction (a)—purchase of direct materials. Exhibit 20-8, Panel C, provides a general-ledger overview of this version of backflush costing. Entries are keyed to Exhibit 20-7, Panel C. Compare entry (c) in Exhibit 20-7, Panel C, with entries (a) and (c) in Exhibit 20-7, Panel A. The simpler version in Example 3 ignores the $1,950,000 purchases of direct materials [shown in entry (a) of Example 1]. At the end of April, $50,000 of direct materials purchased have not yet been placed into production ($1,950,000 — $1,900,000 $50,000). nor have the cost of those direct materials been entered into the inventory-costing system. The Example 3 version of backflush costing is suitable for a JIT production system in which both direct materials inventory and work-in-process inventory are minimal. Extending Example 3, backflush costing systems could use the sale of finished goods

as the only trigger point. This version of backflush costing is most suitable for a JIT production system with minimal direct materials, work-in-process, and finished goods inventories. That’s because this backflush costing system maintains no inventory accounts.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav