Baldwin acquired a 30% interest in a joint venture, Celdron, for $50,000 on January 1, 2011. The

Question:

Baldwin acquired a 30% interest in a joint venture, Celdron, for $50,000 on January 1, 2011. The equity of Celdron at the acquisition date was:

Share capital ...... $ 30,000

Retained earnings .... 120,000

$150,000

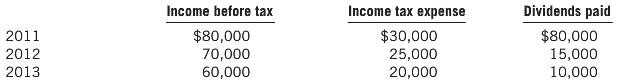

All the identifiable assets and liabilities of Celdron were recorded at fair value. Net income and dividends for the years ended December 31, 2011 to 2013 were as follows:

Required

(a) Prepare journal adjustments in the books of Baldwin for each of the years ended December 31, 2011, to 2013, in relation to its investment in the joint venture, Celdron.

(b) Prepare the consolidated financial statement adjustments to account for Baldwin's interest in the joint venture, Celdron.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: