Barkway Inc. (Barkway) is in the process of finalizing its cash flow statement for 2018. The statement

Question:

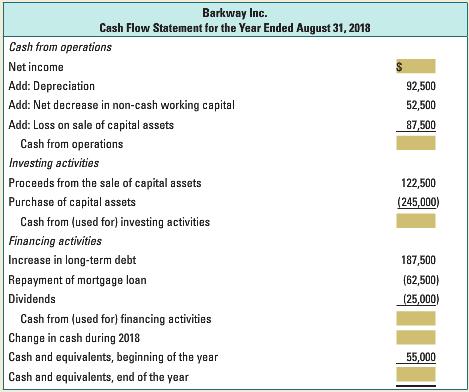

Barkway Inc. (Barkway) is in the process of finalizing its cash flow statement for 2018. The statement has been completely prepared except for the new product development costs that the controller hasn't decided how to account for. The controller has been examining IAS 38 on intangible assets and realizes that considerable judgment is needed in accounting for product development costs. The controller's interpretation of the facts suggests that capitalizing or expensing the development costs could be supported. Preliminary net income, before accounting for the development costs, is $242,500. The product development costs for the year are $205,000. Barkway's preliminary cash flow statement is shown below (the product development costs aren't reflected in the cash flow statement):

Required:

a. Complete the cash flow statement (shaded boxes) assuming that

i. The new product development costs are capitalized and amortized; assume that if the product development costs are capitalized, it isn't necessary to depreciate any of the costs in 2018.

ii. The new product development costs are expensed as incurred

b. Compare the two cash flow statements. How do they influence your evaluation of Barkway?

c. How are the balance sheet and income statement affected by the different accounting treatments for the new product development costs?

d. If Barkway's management received bonuses based on net income, which treatment for the product development costs do you think they would prefer? Explain.

Intangible AssetsAn intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: