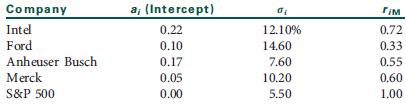

Based on five years of monthly data, you derive the following information for the companies listed: a.

Question:

Based on five years of monthly data, you derive the following information for the companies listed:

a. Compute the beta coefficient for each stock.

b. Assuming a risk-free rate of 8 percent and an expected return for the market portfolio of 15 percent, compute the expected (required) return for all the stocks and plot them on the SML.

c. Plot the following estimated returns for the next year on the SML and indicate which stocks are undervalued or overvalued.

• Intel—20 percent

• Ford—15 percent

• Anheuser Busch—19 percent

• Merck—10 percent

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Beta Coefficient

Beta coefficient is a measure of sensitivity of a company's stock price to movement in the broad market index. It is an indicator of a stock's systematic risk which is the undiversifiable risk inherent in the whole financial system. Beta coefficient... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investment Analysis and Portfolio Management

ISBN: 978-0538482387

10th Edition

Authors: Frank K. Reilly, Keith C. Brown

Question Posted: