BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry, sells

Question:

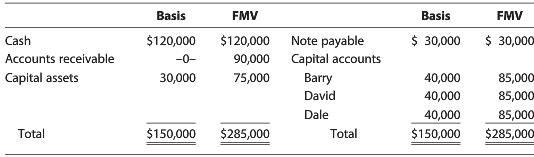

BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry, sells his interest to another partner, Dale, for $90,000 cash and the assumption of Barry’s share of partnership liabilities. Immediately before the sale, the partnership’s cash basis balance sheet is as shown below. Assume that the capital accounts before the sale reflect the partners’ bases in their partnership interests, excluding liabilities. The payment exceeds the stated fair market value of the assets because of goodwill that is not recorded on the books.

a. What is the total amount realized by Barry on the sale?

b. How much, if any, ordinary income must Barry recognize on the sale?

c. How much capital gain must Barry report?

d. What is Dale’s basis in the partnership interest acquired?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young