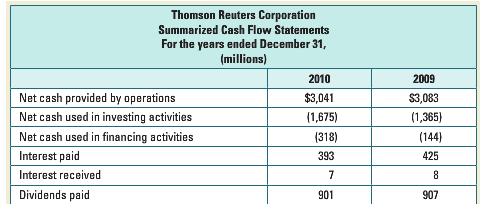

Below is a summarized cash flow statement of Thomson Reuters Corporation, the international provider of information. The

Question:

Below is a summarized cash flow statement of Thomson Reuters Corporation, the international provider of information. The amounts exclude interest paid and received and dividends paid during 2010 and 2009. IFRS allows companies to choose to include interest and dividends paid an operating or financing cash flow and interest received as either operating or investing cash flows.

Required:

a. Recalculate each category of Thomson Reuters’ 2009 and 2010 cash flows under the following assumptions:

i. Treat dividends, interest received, and interest paid as operating cash flows;

ii. Treat dividends and interest paid as financing cash flows, and interest received as an investing cash flow;

iii. Treat dividends as a financing cash flow and interest paid and received as operating cash flows (this is what Thomson Reuters does).

b. Interpret the results you obtained in part (a).

c. What is the economic impact of the different treatments?

d. Which treatment do you think is most useful to stakeholders? Explain your answer.

e. Why do you think Thomson Reuters would choose the approach it used?

StakeholdersA person, group or organization that has interest or concern in an organization. Stakeholders can affect or be affected by the organization's actions, objectives and policies. Some examples of key stakeholders are creditors, directors, employees,...

Step by Step Answer: