Ben Fun, Inc., manufactures video games. Market saturation and technological innovations have caused pricing pressures, which have

Question:

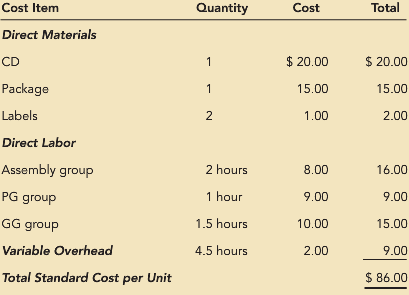

The more aggressive assembly group production supervisors have pressured maintenance personnel to attend to their machines at the expense of other groups. This has resulted in machine downtime in the PG and GG groups, which, when coupled with demands for accelerated delivery by the assembly group, has led to more frequent rejections and increased friction among departments. Ben Fun operates under a standard cost system. The standard costs for video games are as follows:

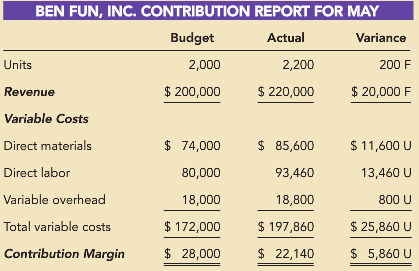

Ben Fun prepares monthly performance reports based on standard costs. Presented in the following table is the contribution report for May, when production and sales both reached 2,200 units:

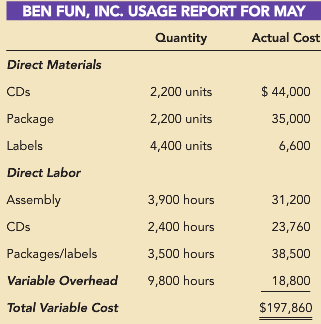

Ben Fun€™s top management was surprised by the unfavorable contribution margin, given the increased sales in May. Al Miller, the cost accountant, was assigned to identify and report on the reasons for the unfavorable contribution margin results as well as the individuals or groups responsible. After completing his review, Miller prepared the following usage report:

Miller reported that the PG and GG groups supported the increased production levels but experienced abnormal machine downtime, causing idle labor, which required the use of overtime to keep up with the accelerated demand for parts. The idle time was charged to direct labor. Miller also reported that the production managers of these two groups resorted to parts rejection as opposed to testing and modification procedures as used in the past. Miller determined that the assembly group met management€™s objectives by increasing production while using lower-than-standard hours.

Required

A. For May, Ben Fun€™s labor rate variance was $5,660 unfavorable, and the labor efficiency variance was $200 favorable. By using these two variances and calculating the following five variances, prepare an explanation of the $5,860 unfavorable variance between budgeted and actual contribution margins during May.

a. Material price variance

b. Material quantity variance

c. Variable overhead efficiency variance

d. Variable overhead spending variance

e. Sales volume variance

B. Tell the story of the variances.

C. Identify and briefly explain the behavioral factors that may promote friction among the production managers and between the production managers and the maintenance manager.

D. Evaluate Al Miller€™s analysis of the unfavorable contribution results in terms of its completeness and its effect on the behavior of the production groups. What decisions need to be made about increasing the contribution margin?

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins