BestFix inc. is a service companies that rents and repairs skates and skis in the Ottawa area

Question:

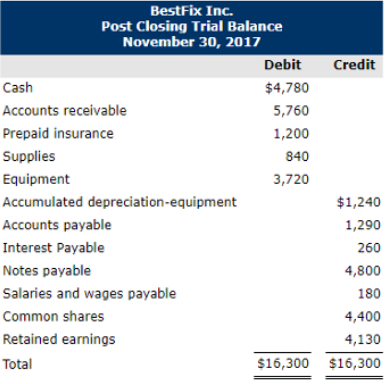

BestFix inc. is a service companies that rents and repairs skates and skis in the Ottawa area on November 30, 2017. Best fix Inc's post-closing trial balance was as follows.

1. Prepare the journal entries for the following December transaction:

a. Dec. 1 Purchased supplies on account for 5400.

b. Dec. 11 Received $90 in advance from a customer for repairing of skates. Skates will not be repaired until December 16.

c. Dec. 15 Issued common shares for $440 cash and $220 of supplies.

d. Dec. 16 Completed the repair of skates brought in on December 11.

e. Dec. 22 Paid $410 of the accounts payable owing at the end of November.

f. Dec. 28 Received 9750 from customers in payment of accounts.

g. Dec. 29 Paid $460 of dividends.

h. Dec. 29 Paid salaries and wages of $1.060, which included the full amount of the salaries payable.

i. Throughout the month of December, received $4,400 for skate and ski rental: of which 10% were on account.

2. Prepare adjusting entries for the following:

j. The prepaid insurance is a 12 month policy that was purchased on June 1, 2017 at cost of $2,400.

k. The supplies inventory at December 31, 2017 shows a value of $110.

l. The equipment has an estimated useful life of 5 years.

m, Total payroll is $1.080 for employees, paid on the last Wednesday of the month for wages earned during the prior 30 working days (Mondays to Fridays). Wages were lest paid and recorded on Wednesday December 29th.

n. The short-term note payable bears interest of 10%. The note was as taken out on June 1. 2017. The interest is payable on June 1. 2018.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann