Beth, Steph, and Linda have been operating a small gift shop for several years. After an extensive

Question:

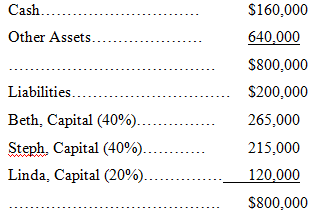

Beth, Steph, and Linda have been operating a small gift shop for several years. After an extensive review of their past operating performance, the partners concluded that the business needed to expand in order to provide an adequate return to the partners. The following balance sheet is for the partnership prior to the admission of a new partner, Mary.

Figures shown parenthetically reflect agreed profit-and-loss sharing percentages.

Required:

Prepare the necessary journal entries to record the admission of Mary in each of the following independent situations. Some situations may be recorded in more than one way.

1. Mary is to invest sufficient cash to receive a one-sixth capital interest. The parties agree that the admission is to be recorded without recognizing goodwill or bonus.

2. Mary is to invest $160,000 for a one-fifth capital interest.

3. Mary is to invest $160,000 for a one-fourth capital interest.

4. Mary is to invest $160,000 for a 40% capital interest.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: