Boston Turkey is a publicly traded firm, with the following income statement and balance sheet from its

Question:

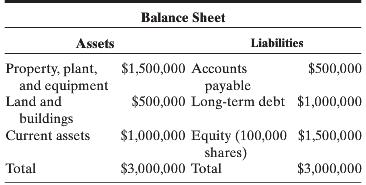

Boston Turkey is a publicly traded firm, with the following income statement and balance sheet from its most recent financial year:

Income Statement Revenues ……………………$1,000,000

− Expenses …………………………… $400,000

− Depreciation ………………………. $100,000

EBIT …………………………………. $500,000

− Interest expense …………………… $100,000

Taxable income …………………….. $400,000

− Tax ………………………………... $160,000

Net income ………………………….. $240,000

Boston Turkey expects its revenues to grow 10% next year and its expenses to remain at 40% of revenues.

The depreciation and interest expenses will remain unchanged at $100,000 next year. The working capital, as a percentage of revenue, will also remain unchanged next year.

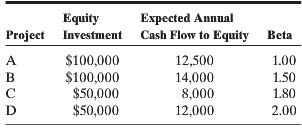

The managers of Boston Turkey claim to have several projects available to choose from next year, in which they plan to invest the funds from operations, and they suggest that the firm really should not be paying dividends. The projects have the following characteristics:

The Treasury bill rate is 3%, and the Treasury bond rate is 6.25%. The firm plans to finance 40% of its future net capital expenditures (Cap Ex − Depreciation) and working capital needs with debt.

a. How much can the company afford to pay in dividends next year?

b. Now assume that the firm actually pays out $1.00 per share in dividends next year. The current cash balance of the firm is $150,000. How much will the cash balance of the firm be at the end of next year, after the payment of the dividend?

Step by Step Answer: