Bramlett Company has several divisions and just built a new plant with a capacity of 20,000 units

Question:

Bramlett Company has several divisions and just built a new plant with a capacity of 20,000 units of a new product. A standard costing system has been introduced to aid in evaluating managers’ performance and in establishing a selling price for the new product. At the present time, Bramlett faces no competitors in this product market, and managers priced it at standard variable and fixed manufacturing cost, plus 60% markup. Managers hope this price will be maintained for several years. During the first year of operations, 1,000 units per month will be produced. During the second year of operations, production is estimated to be 1,500 units per month. In the first month of operations, employees were learning the processes, so direct labor hours were estimated to be 20% greater than the standard hours allowed per unit. In subsequent months, employees were expected to meet the direct labor hours standards.

Experience in other plants and with similar products led managers to believe that variable manufacturing costs would vary in proportion to actual direct labor costs. For the first several years, only one product will be manufactured in the new plant. Fixed overhead costs of the new plant per year are expected to be $1,920,000 incurred evenly throughout the year.

The standard variable manufacturing cost (after the one-month learning period) per unit of product has been set as follows:

Direct materials (4 pieces @ $20 per piece) ……….. $ 80

Direct labor (10 hours @ $25 per hour) ……………. 250

Variable overhead (50% of direct labor cost) ………. 125

Total ……………………………………………...................……. $455

At the end of the first month of operations, the actual costs incurred to make 950 units of product were as follows:

Direct materials (3,850 pieces @ $19.80) ………. $ 76,230

Direct labor (12,000 hours @ $26) ……………… 312,000

Variable overhead ………………………………. 160,250

Fixed overhead …………………………………. 172,220

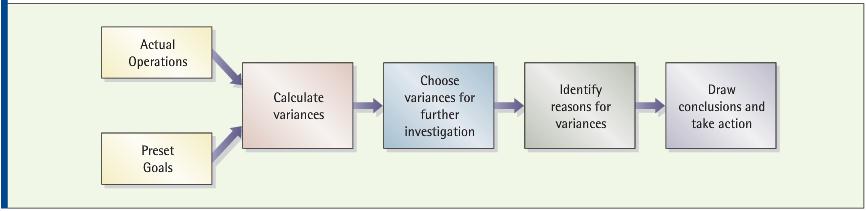

Bramlett managers want to compare actual costs to standard, analyze and investigate variances, and take corrective action if needed.

REQUIRED

A. What selling price should Bramlett set for the new product according to the new pricing policy? Explain.

B. Using the standard costs listed above, compute all direct labor and manufacturing overhead variances.

C. Is it reasonable to use the variance calculations in part (B) for the first month of operations?

Why or why not?

D. Revise the variance calculations in part (B), using the expected costs during the first month of operations as the standard costs.

E. Provide at least two possible explanations for each of the following variances:

1. Direct labor price variance

2. Direct labor efficiency variance

3. Variable overhead spending variance

4. Fixed overhead spending variance

F. As shown in Exhibit, the reasons for variances must be identified before conclusions and actions are decided upon. For two of the variance explanations you provided in part

(E), explain what action(s) managers would most likely take.

G. Would it most likely be easier or more difficult to analyze the variances at the new plant compared to Bramlett’s other plants? Explain.

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott