Broadhead Company uses a periodic inventory system. At the end of the annual accounting period, December 31,

Question:

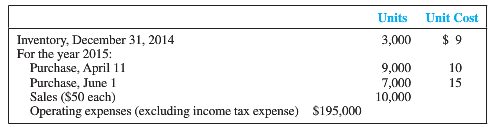

Broadhead Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2015, the accounting records provided the following information for product 2:

Required:

1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. For each case, show the computation of the ending inventory and cost of goods sold.

2. Compare the pretax income and the ending inventory amounts between the two cases. Explain the similarities and differences.

3. Which inventory costing method may be preferred for income tax purposes? Explain.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0078025556

8th edition

Authors: Robert Libby, Patricia Libby, Daniel Short

Question Posted: