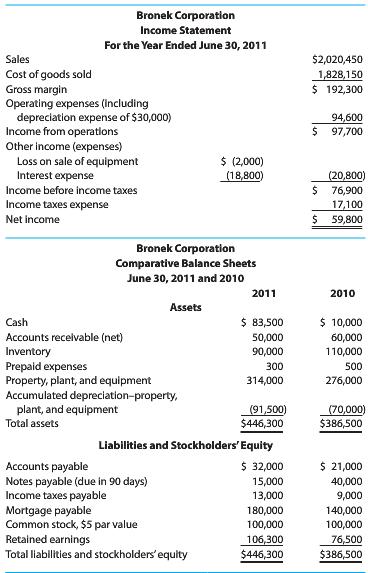

Bronek Corporations income statement for the year ended June 30, 2011, and its comparative balance sheets as

Question:

Bronek Corporation’s income statement for the year ended June 30, 2011, and its comparative balance sheets as of June 30, 2011 and 2010 follow. During 2011, the corporation sold at a loss of $2,000 equipment that cost $12,000, on which it had accumulated depreciation of $8,500. It also purchased land and a building for $50,000 through an increase of $50,000 in mortgage payable, made a $10,000 payment on the mortgage, repaid notes ($40,000) but borrowed an additional $15,000 through the issuance of a new note payable of $40,000, and declared and paid a $30,000 cash dividend.

REQUIRED

1. Using the indirect method, prepare a statement of cash flows. Include a supporting schedule of noncash investing and financing transactions.

2. What are the primary reasons for Bronek Corporation’s large increase in cash from 2010 to 2011?

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer: