Budgeted selling and administrative expenses for Royal Tire Co. in P7-2 for the year ended December 31,

Question:

Budgeted selling and administrative expenses for Royal Tire Co. in P7-2 for the year ended December 31, 2013, were as follows:

In P7-2, Royal Tire Co.'s budgeted unit sales for the year 2013 were:

Passenger-car tires . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,000

Truck tires . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,000

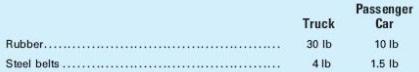

The budgeted selling price for truck tires was $200 per tire, and for passenger car tires it was $65 per tire. The beginning finished goods inventories were expected to be 2,000 truck tires and 5,000 passenger tires, for a total cost of $326,478, with desired ending inventories at 2,500 and 6,000, respectively, with a total cost of $400,510. There was no anticipated beginning or ending work-in-process inventory for either type of tire. The standard materials quantities for each type of tire were as follows:

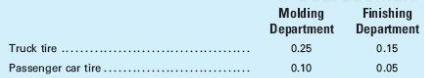

The purchase prices of rubber and steel were $2 and $3 per pound, respectively. The desired ending inventories for rubber and steel were 60,000 and 6,000 lb, respectively. The estimated beginning inventories for rubber and steel were 75,000 and 7,000 lb, respectively. The direct labor hours required for each type of tire were as follows:

The direct labor rate for each department is as follows:

Molding Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15 per hour

Finishing Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13 per hour

Budgeted factory overhead costs for 2013 were as follows:

Indirect materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$198,500

Indirect labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213,200

Depreciation of building and equipment . . . . . . . . . . . . . . . . 57,500

Power and light . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122,900

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $692,100

Advertising expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $942,000

Office rent expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125,000

Office salaries expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 821,000

Office supplies expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,500

Officers' salaries expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 661,000

Sales salaries expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 868,000

Telephone and fax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,500

Travel expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 443,000

Required:

1. Prepare a selling and administrative expense budget, in good form, for the year 2013.

2. Using the information above and the budgets prepared in P7-2, prepare a budgeted income statement for the year 2013, assuming an income tax rate of 40%.

Step by Step Answer: