Budgeting; direct material usage, manufacturing cost and gross margin. Xerxes Manufacturing Company manufactures blue rugs, using wool

Question:

Budgeting; direct material usage, manufacturing cost and gross margin. Xerxes Manufacturing Company manufactures blue rugs, using wool and dye as direct materials. All other materials are indirect. At the beginning of the year Xerxes has an inventory of 349,000 skeins of wool at a cost of $715,450 and 5,000 gallons of dye at a cost of $24,850. Target ending inventory of wool and dye is zero. Xerxes uses the FIFO inventory cost flow method.

One blue rug is budgeted to use 30 skeins of wool at a cost of $2 per skein and 1/2 gallon of dye at a cost of $5 per gallon.

Xerxes blue rugs are very popular and demand is high, but because of capacity constraints the firm will produce only 100,000 blue rugs per year. The budgeted selling price is $2,000 each. There are no rugs in beginning inventory. Target ending inventory of rugs is also zero.

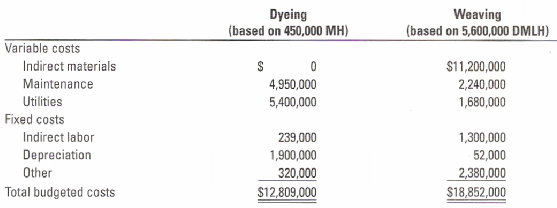

Xerxes makes rugs by hand, but uses a machine to dye the wool. Thus, overhead costs are accumulated in two cost pools—one for weaving and the other for dyeing. Weaving overhead is allocated to product based on direct manufacturing labor-hours (DMLH). Dyeing overhead is allocated to product based on machine-hours (MH).

There is no direct manufacturing labor cost for dyeing. Xerxes budgets 56 direct manufacturing labor-hours to weave a rug at a budgeted rate of $15 per hour. It budgets 0.15 machine-hours to dye each skein in the dyeing process.

The following table presents the budgeted overhead costs for the dyeing and weaving cost pools:

1. Prepare a direct material usage budget in both units and dollars.

2. Calculate the budgeted overhead allocation rates for weaving and dyeing.

3. Calculate the budgeted unit cost of a blue rug for the year.

4. Prepare a revenue budget for blue rugs for the year, assuming Xerxes sells (a) 100,000 or (b) 95,000 blue rugs (that is at two different sales levels).

5. Calculate the budgeted cost of goods sold for blue rugs under each sales assumption.

6. Find the budgeted gross margin for blue rugs under each sales assumption.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav