Assume that you are purchasing an investment and have decided to invest in a company in the

Question:

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital, Corp., and Every Zone, Inc., and have assembled the following data.

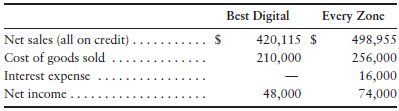

Selected income statement data for the current year:

.:.

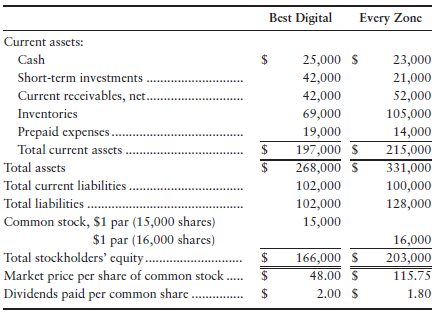

Selected balance sheet and market price data at the end of the current year:

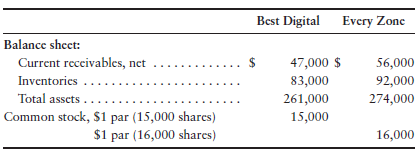

Selected balance sheet data at the beginning of the current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirement

1. Compute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy.

a. Acid-test ratio

b. Inventory turnover

c. Days’ sales in receivables

d. Debt ratio

e. Earnings per share of common stock

f. Price/earnings ratio

g. Dividend payout

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-0132497978

3rd Edition

Authors: Horngren, Harrison, Oliver