Fernandez Corp. invested its excess cash in available-for-sale securities during 2012. As of December 31, 2012, the

Question:

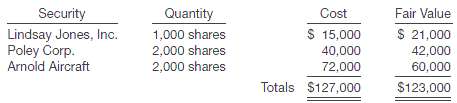

Fernandez Corp. invested its excess cash in available-for-sale securities during 2012. As of December 31, 2012, the portfolio of available-for-sale securities consisted of the following common stocks.

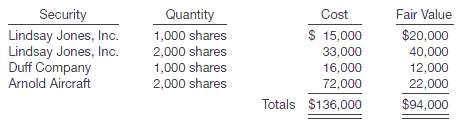

Instructions(a) What should be reported on Fernandez??s December 31, 2012, balance sheet relative to these securities? What should be reported on Fernandez??s 2012 income statement? On December 31, 2013, Fernandez??s portfolio of available-for-sale securities consisted of the following common stocks.

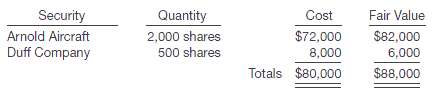

During the year 2013, Fernandez Corp. sold 2,000 shares of Poley Corp. for $38,200 and purchased 2,000 more shares of Lindsay Jones, Inc. and 1,000 shares of Duff Company.(b) What should be reported on Fernandez??s December 31, 2013, balance sheet? What should be reported on Fernandez??s 2013 income statement?On December 31, 2014, Fernandez??s portfolio of available-for-sale securities consisted of the following common stocks.

During the year 2014, Fernandez Corp. sold 3,000 shares of Lindsay Jones, Inc. for $39,900 and 500 shares of Duff Company at a loss of $2,700.(c) What should be reported on the face of Fernandez??s December 31, 2014, balance sheet? What should be reported on Fernandez??s 2014 income statement?(d) What would be reported in a statement of comprehensive income at (1) December 31, 2012, and (2) December 31,2013?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: