Presented below is an amortization schedule related to Spangler Company??s 5-year, $100,000 bond with a 7% interest

Question:

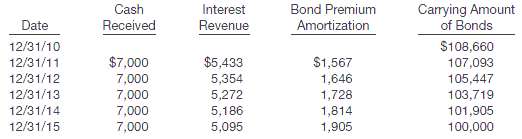

Presented below is an amortization schedule related to Spangler Company??s 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 2010, for $108,660.

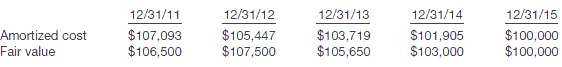

The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end.

Instructions(a) Prepare the journal entry to record the purchase of these bonds on December 31, 2010, assuming the bonds are classified as held-to-maturity securities.(b) Prepare the journal entry(ies) related to the held-to-maturity bonds for 2011.(c) Prepare the journal entry(ies) related to the held-to-maturity bonds for 2013.(d) Prepare the journal entry(ies) to record the purchase of these bonds, assuming they are classified as available-for-sale.(e) Prepare the journal entry(ies) related to the available-for-sale bonds for 2011.(f) Prepare the journal entry(ies) related to the available-for-sale bonds for2013.

Step by Step Answer: